SWIFTPE MICRO SERVICES FOUNDATION

Sweiftpe Micro Service Foundtion Tread Merk Kisalay Microfinance is a non-depositing non-banking financial institution under SwiftPe Microservices Foundation (NBFC) registered with the Reserve Bank of India. Established in 2020, we have been

engaged in the financial field for more than 02 years.

And our businesses have been expanded from traditional financial services to online financial services for the past 02 years, keeping pace with the advancement of fintech.

Loans we offer

Personal Loan

Best Personal Loans through us with low interest rates and fulfill your urgent needs.

property Loan

not available

business Loan

Apply now with us to complete your instant business need, fast & easy approval process.

home Loan

not available

Membership Loan

A membership loan is a loan made by a member or managing member of a borrower, or their affiliates.

Our Service

swiftpe miro servies Startup India Private Limited focus is to delight our customers by helping them choose best Online Loans, Personal Loans, Business Loans, check your loan eligibility with us and we will help you to get best loans as per your eligibility. Call Us Now for more details

CIBIL LINK

https://hub.crifhighmark.com/Inquiry/Inquiry/login.action

E-NACH LINK

http://swiftypeenach.allservices.co.in/

Loan app Download Link

https://drive.google.com/file/d/1uKCNEbJG6_hJqWWh8VfaW64jv_z2SN8p/view?usp=drivesdk

ADMIN USE–http://swiftype.allservices.co.in/

Let the Number Speak for Us

We Have

Clients in

Successful

work with

Successfully completed

We have

more than

Your Money is few steps away

Step - 1

Complete KYC

Step - 2

Sub-Approval

Step - 3

Customer Visit

Step - 4

Final Approval

Step - 5

Loan Disbursement

Apply for Online Loans Now, We will guide you for taking Riskfree Loan

Kisalay Microfinance Startup India Private Limited

Our Banking Partners

testimonials

MSME Certification

About us

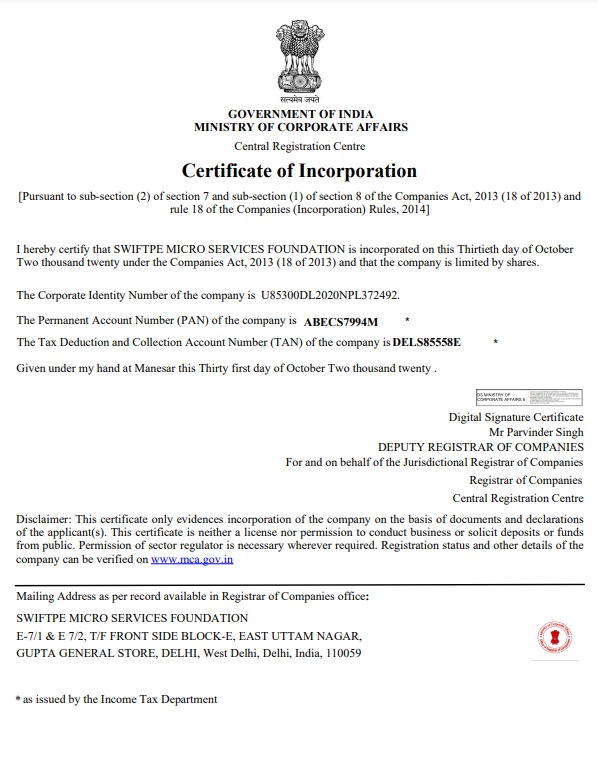

SWIFTPE MICRO SERVICE FOUNDATION provides loans to joint liability groups as well as individuals. Besides lending for income generation activities under the joint liability group (JLG) model, the company provides a wide range of products including sanitation loans, housing loans, utility loans,SELF HELP GROUP (SHG)individual loans and MSME loans and to meet the financial needs of its customers. CIN: U85300DL2020NPL372492